ATM fees for PH interbank transactions in 2021 - Android

Attention, ATM cardholders: starting April 7, cash withdrawal fees will be more expensive when you use an automated teller machine (ATM) that is not from your debit card’s issuing bank. The increase in interbank ATM fees, also called acquirer-based charges for ATM transactions, will vary, as it is up to each bank to decide how […]

This article, ATM fees for PH interbank transactions in 2021, was originally published at NoypiGeeks | Philippines Technology News, Reviews and How to's.

Attention, ATM cardholders: starting April 7, cash withdrawal fees will be more expensive when you use an automated teller machine (ATM) that is not from your debit card’s issuing bank.

The increase in interbank ATM fees, also called acquirer-based charges for ATM transactions, will vary, as it is up to each bank to decide how much of a price hike they will impose on non-clients.

The Bank of the Philippine Islands, for instance, will charge ₱18 from its current ₱15 for withdrawals. Metrobank will also charge this higher amount. BDO Unibank, UnionBank, and Security Bank will charge ₱11, ₱12, and ₱10 respectively. Many banks will also increase balance inquiry fees to ₱2.

In 2019, to allow competitiveness among banks, the Bangko Sentral ng Pilipinas lifted a moratorium that mandated banks to have a uniform interbank withdrawal fee. To help cardholders make a choice, the central bank has also directed banks to clearly display on ATM locations how much they’ll charge on withdrawals and balance inquiries.

In most cases, ATM cardholders need not worry about any withdrawal fees if they stick to their banks’ ATMs.

This article, ATM fees for PH interbank transactions in 2021, was originally published at NoypiGeeks | Philippines Technology News, Reviews and How to's.

10/02/2021 12:06 PM

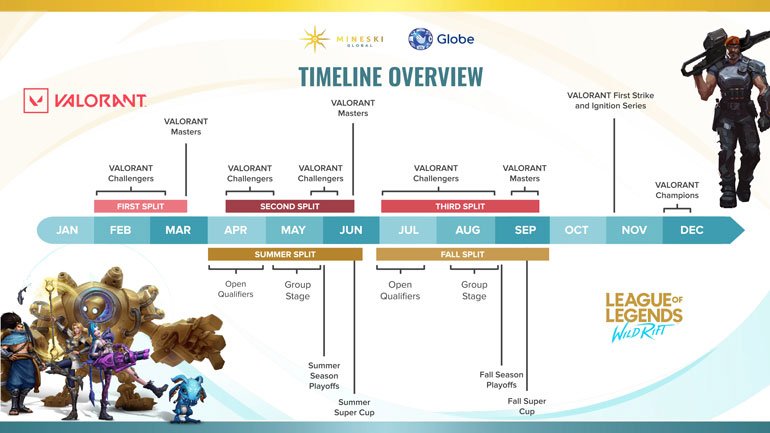

Mineski PH to bring several Esports tournaments to the Philippines in 2021

10/02/2021 10:43 AM

The Glass Garden at SM Megamall serves romance on the menu

10/02/2021 07:10 AM

The All-New Honda X-ADV - Ride into the future

10/02/2021 05:13 AM

Volvo PH shares decades of knowledge about child safety in cars

10/02/2021 07:23 AM

Get massive discounts and freebies on MSI laptop deals this Chinese New Year

10/02/2021 12:17 PM

XTREME launches new line-up of appliances for home revamp

10/02/2021 12:17 PM

Hyundai unveils TIGER Uncrewed Ultimate Mobility Vehicle Concept

10/02/2021 06:44 AM

- HEALTH

- Comics

- Libraries & Demo

- Sports Games

- Racing

- Photography

- Transportation

- Media & Video

- Sports

- Health & Fitness

- Weather

- Medical

- Cards & Casino

- Arcade & Action

- Personalization

- Social

- Communication

- Productivity

- Casual

- Shopping

- Tools

- Brain & Puzzle

- Business

- News & Magazines

- Finance

- Lifestyle

- Music & Audio

- Entertainment

- Travel & Local

- Books & Reference

- Education