Digital Banks in the Philippines - Android

We are now on the road to pandemic year two, and going out is still uncertain. With the pandemic still in place, digital banks...

The post Digital Banks in the Philippines appeared first on YugaTech | Philippines Tech News & Reviews.

We are now on the road to pandemic year two, and going out is still uncertain. With the pandemic still in place, digital banks in the country are present to help people complete banking transactions completely online in the safety of their homes. People can also take advantage of various perks such as online applications, cashless fund transfers, higher interest rates, and more, thanks to these platforms that are easily accessible. More of the said transactions are all conducted within its mobile app, offering convenience to customers. With that said, here is the list of some digital banks in the Philippines that you can try.

Author’s note: The following digital banks are members of the Philippine Deposit Insurance Corporation (PDIC) and regulated by the Bangko Sentral ng Pilipinas (BSP). The banks included in this list allow us to open an account without going to the branch for safety reasons during the pandemic.

DiskarTech

DiskarTech is the Philippines’ first all-in-one “Taglish” inclusion app powered by Rizal Commercial Banking Corporation (RCBC). As per RCBC, the app will assist as a reliable and convenient platform with multiple features, including sachet banking products, digital banking services, and quick healthcare solutions.

Diskartech lets users open a savings account, deposit or withdraw money, buy mobile load, insurances, and the like. DiskarTech allows you to do more than just opening a bank account. It offers an interest rate of 3.25% per annum, allowing users to save their money by keeping it in their DiskarTech account. Plus, no minimum deposit or maintaining balance is required.

Through DiskarTech, users may set “Ipon” goals, buy load, pay bills, buy Insurance plans, and avail of telemedicine service. Plus, users may also earn money via referral.

To know more about DiskarTech, check out: DiskarTech: What you need to know.

Download DiskarTech: Android | iOS

ING Philippines

ING has a presence in more than 40 countries and recognized as a universal bank supervised by the Bangko Sentral ng Pilipinas (BSP). It is also a member of the Philippine Deposit Insurance Corporation (PDIC). ING Philippines has been present since 1990, providing wholesale banking services to international and local corporations.

Customers may open a savings account through the ING app and submit proof of address and one government-issued ID. Do note that applicants must be Filipino citizens who are 18 years old and residents of the Philippines. Currently, account holders may enjoy a high-interest rate of 2.5% p.a. for an available daily balance of PHP 20M or lower, earn an additional 1% gross p.a. for an available daily balance above PHP 20M, no minimum maintaining balance, the online deposit of checks, limitless fund transfers per day, and free interbank fund transfer via PESONet and InstaPay from the ING app.

Those with ING Savings Account may activate their Pay Account, which can be used for chargeless bills payment and online shopping through the virtual card. Until March 31, 2021, ING offers all first-time customers with an available daily balance of less than or up to PHP 20 million to their Savings Account an interest rate of 4% per annum for the first 4 months from their date of account opening.

Download ING Philippines: Android | iOS

CIMB Bank

CIMB Bank Philippines is an all-digital, mobile-first bank in the country with over 2 million customers. Commonly known for its affiliation with GCash’s GSave, the digital bank offers online applications through the app as fast as 10 minutes. It offers zero initial deposit, zero maintaining balance required, zero transaction fees, and a personalized Visa payWave debit card that can be delivered for free.

GSave is the first-ever bank account that you can open and maintain straight from the GCash app. Users may link their GSave account to the CIMB Bank PH and unlock the full features of their account. Users may also start growing their savings with CIMB’s interest rate of 3.1% p.a.

Customers may open either of the following accounts: Fast Account for a more simplified account opening process with minimal information provided and the expiration of 12 months, Fast Plus Account with a higher yearly interest rate of 0.75% p.a, and the high interest-bearing UpSave account. The first two accounts come with a debit card with a cumulative cash-in of PHP 5,000 and successful document verification within the app.

Meanwhile, the UpSave Account has an interest rate of 3.0% p.a. and doesn’t come with a debit card. Although cash-in and deposits from partner locations are free across the three types of accounts in CIMB, the Fast Plus and Fast Accounts allow users to withdraw from over 20,000 Bancnet-affiliated ATMs nationwide.

Download CIMB Bank Philippines: Android | iOS | Huawei AppGallery

Tonik Digital Bank

Tonik is a digital-only bank that was recently launched in the country. Tonik Financial Pte Ltd is based in Singapore and focuses on product development and technology integration for its digital banking platform. Tonik’s banking operations in the Philippines are conducted by its local subsidiary Tonik Digital Bank Inc, regulated by Bangko Sentral ng Pilipinas as a rural bank.

A Tonik account does not have a minimum balance requirement. Plus, there are also no dormancy fees, minimum deposits, and account closure fees. Currently, Tonik allows users to open up to five Solo and Group Stashes and up to five Time Deposit accounts. Further, Tonik offers deposit interest rates of up to 6% per annum, free Tonik to Tonik transfers, as well as free transfers to other banks.

Upon onboarding, the customer is issued a virtual Mastercard debit card that can be used for various e-merchants. The free Virtual Debit Card enables users to shop via e-commerce platforms, pay bills, and make other transactions online. The app says that a physical debit card is coming soon.

To know more about Tonik, check out: Tonik Digital Bank: What you need to know.

Download Tonik Digital Bank: Android | iOS

Maybank’s iSave

Maybank Philippines offers an online-only savings account through iSave. All forms and documentary requirements are submitted via the Maybank2U PH app. It doesn’t require an initial deposit or maintaining balance and earns a 0.25% yearly interest once you reach a balance of PHP 20,000.

It also comes with an EMV enabled ATM card so that you can withdraw your funds from any ATM in the Philippines for free. You can also withdraw from any Maybank ATM in Malaysia, Singapore, and Cambodia for free.

Funding an iSave account is done via over-the-counter deposits in any Maybank branches, interbank fund transfers, GCash bank transfer, or deposit outlets such as 7-Eleven, RD Pawnshop, USSC, Tambunting Pawnshop, and more. Do note that an iSave account still needs to be verified by Maybank within 12 months upon opening. It has a maximum deposit limit of PHP 100,000 and restricts foreign remittances.

Download Maybank: Android | iOS

HelloMoney

Backed by Asia United Bank, HelloMoney allows people to open a prepaid bank account with no monthly fees, maintaining balance, and initial deposit. Customers may open a HelloMoney account through the app other partner outlets, transfer funds to other bank accounts and e-wallets, accept QR code payments, manage ATM cards, and pay bills. There’s an option to avail and link an ATM card for those who want to withdraw through ATMs.

There are three ways to cash-in on HelloMoney: over-the-counter deposits in any AUB Branch, adding money through Instapay from other Philippine banks, and fund transfer from other AUB or HelloMoney accounts. Monthly maximum cash-in transactions and maximum fund limit to save in a HelloMoney account are capped at PHP 200,000. Do note that some billers may charge a service fee for processing the transaction, and only those 18 years old and above are eligible to apply for a HelloMoney account. Account-holders are only allowed to link one HelloMoney ATM card at a time.

Download HelloMoney: Android | iOS

UnionBank

UnionBank improves its banking services, allowing new customers to open a specific savings account that fits their digital needs. Although it has a physical branch, UnionBank offers specific banking products that only accept online applications through its online website and mobile apps.

This includes the Lazada Debit Card for online shoppers, PlayEveryday savings account for those who like to earn rewards and points, GetGo Debit for frequent flyers, Personal Savings for earning interest, and Savings+ for getting free life insurance. Among the five savings account, only the Lazada Debit Card, PlayEveryday, Personal Savings, and GetGo Debit offer no maintaining balance. The first one comes with a virtual card, which the user may view in the app and offers up to two times cashback for every PHP 200 spent at Lazada.

Meanwhile, the Personal Savings account offers a yearly interest rate of 0.10% and requires a minimum available deposit balance of PHP 10,000 to earn interest. Customers may secure online transactions with its two-factor authentication, online bill payment, deposit checks online, buy or send prepaid load, send and receive funds via QR Code, split bills, and more through its mobile app. The service, for now, is limited to Filipinos residing in the Philippines. UnionBank recently waived its interbank fees for fund transfer until March 31, 2021.

Download UnionBank: Android | iOS | Huawei App Gallery

EON

UnionBank’s EON is one of the fully digital banks in the country. This neo banking platform allows clients to apply and access their accounts through the official EON website or the official UnionBank EON app. You can also get EON Visa cards at select UnionBank branches nationwide.

EON offers five types of bank accounts, all depending on various budgets and demands. It includes EON Starter, EON Lite, EON PLus, EON Pro, and EON Cyber. Each EON account has an annual fee of PHP 100 to PHP 350, depending on account type. Moreover, there is no minimum maintaining balance required nor other penalties. EON accounts serve as debit cards, which you can use to collect and add funds, send and receive money, and withdraw cash from ATMs.

One doesn’t need to go to the nearest UnionBank branch to apply for an EON account. The application can be made online or through the EON app. Users may access the EON app using mobile data on any network for free. Aside from applying for an EON account online, users can also get an EON Visa Card at select stores nationwide. The EON Starter Kit card costs PHP 150.

Like UnionBank, EON has extended waived interbank fees for fund transfer via InstaPay until March 31, 2021.

Download EON: Android | iOS

KOMO

EastWest Bank’s subsidiary, KOMO, is a fully digital bank with no physical branches. Its system gives customers full control over their account by account opening, fund transfers, bills payment, and card blocking. KOMO is a shortened version of the Filipino phrase “Kontrol mo ang pera mo, “giving simplified process and financial flexibility to its customers.

Applicants may open their own digital savings account through the app. They must fill up a form and submit a clear copy of their valid government ID and selfie for identity verification. Coming in with a Visa debit card, which will be shipped later on to their registered address, account holders may earn an annual interest rate of up to 3%. Daily interest earned updates daily before being credited to one’s account at the end of the month. It requires users to have a 6-digit password and sends OTP when opening their account through the mobile platform, offers free withdrawals and balance inquiry from EastWest Bank ATMs and Bancnet-affiliated ATMs (up to 4 times only for interbank withdrawals, initial charge will be refunded after 2 log-ins on the app), and has no minimum balance and initial deposit.

It also offers free fund transfer via InstaPay, online bills payment, ATM cash withdrawal up to PHP 10,000 per transaction or PHP 20,000 per day, and online purchase up to PHP 10,000 per transaction or PHP 100,000 per day. Do note that the service is currently available to Filipino citizens.

Download KOMO: Android | iOS

OFBank

The Philippine government, spearheaded by the Department of Finance (DOF) and the Land Bank of the Philippines (LANDBANK), has launched the Overseas Filipino Bank (OFBank) as a digital-only, first branchless Philippine government bank that let clients complete banking transactions across the globe.

As a digital-only facility, OFBank utilizes Digital Onboarding System with Artificial Intelligence (DOBSAI) to facilitate real-time account opening via the OFBank’s Mobile Banking Application. The new digital account opening platform allows overseas Filipinos (OFs), overseas Filipino workers (OFWs), and their beneficiaries to securely and conveniently submit all requirements online.

There are three types of accounts available in OFBANK’s DOBSAI: the OFBank Visa Debit Card for OFs and OFWs, the OFBank Visa Debit Card for beneficiaries, and the OFBank Debit Card for beneficiaries below 18 years old. These are interest-bearing peso savings accounts with no minimum initial deposit and monthly average daily balance (ADB), as well as dormancy fees. However, the accounts need to have a daily balance of PHP 500 to earn interest.

The OFBank Visa Debit Card allows cardholders, specifically the beneficiaries of OFs and OFWs, to receive real-time fund transfers using Visa Direct, Visa’s real-time payment solution through the 16-digit card number. OFBank account holders can also use OFBank’s mobile facility to transfer funds to their beneficiaries’ OFBank, and LANDBANK accounts for free. Interbank fund transfers, on the other hand, are subject to a service fee of PHP 25.00 per transaction via InstaPay and PHP15.00 per transaction via PesoNet.

Download OFBank: Android | iOS

BPI

Another bank worth mentioning is BPI, which allows existing BPI account holders who are either enrolled and unenrolled to the mobile app to open savings accounts online. The initiative aims to provide a more convenient way to open a new saving account under BPI without going to physical branches.

There are two saving accounts that BPI customers may open through the app: a regular savings account and a Maxi-Saver account. Although both come with debit cards, the former comes with a fixed yearly interest rate of 0.125% with an average balance of PHP 5,000 and a minimum deposit and monthly average maintaining balance of PHP 3,000.

The Maxi-Saver, meanwhile, has a minimum deposit and average daily balance of PHP 50,000. Those with a balance amounting to PHP 50,000 to less than PHP 5 million earn 0.125% interest per annum. On the other hand, those with a balance of PHP 5 million have an annual interest rate of 0.25%. A bonus interest of 0.25% per year will be added if no withdrawal is made within a month on a Maxi-Saver account.

Download BPI: Android | iOS

And that sums it up! We hope that we could provide you more options! Have you tried any digital banks from our list? Let us know in the comment section down below.

The post Digital Banks in the Philippines appeared first on YugaTech | Philippines Tech News & Reviews.

Xiaomi Mi Band 6 with full-screen AMOLED and SpO2 tracking revealed

30/03/2021 08:11 AM

Coca-Cola film ‘Kababae Mong Tao’ debunks unconscious biases against women

30/03/2021 08:03 AM

ViewSonic announces new Elite, XG, VX series gaming monitors

30/03/2021 06:12 AM

Xiaomi to launch Smart Electric Vehicle Business

30/03/2021 09:36 AM

Filipinos support Earth Hour PH 2021 and #SpeakUpForNature

30/03/2021 07:20 AM

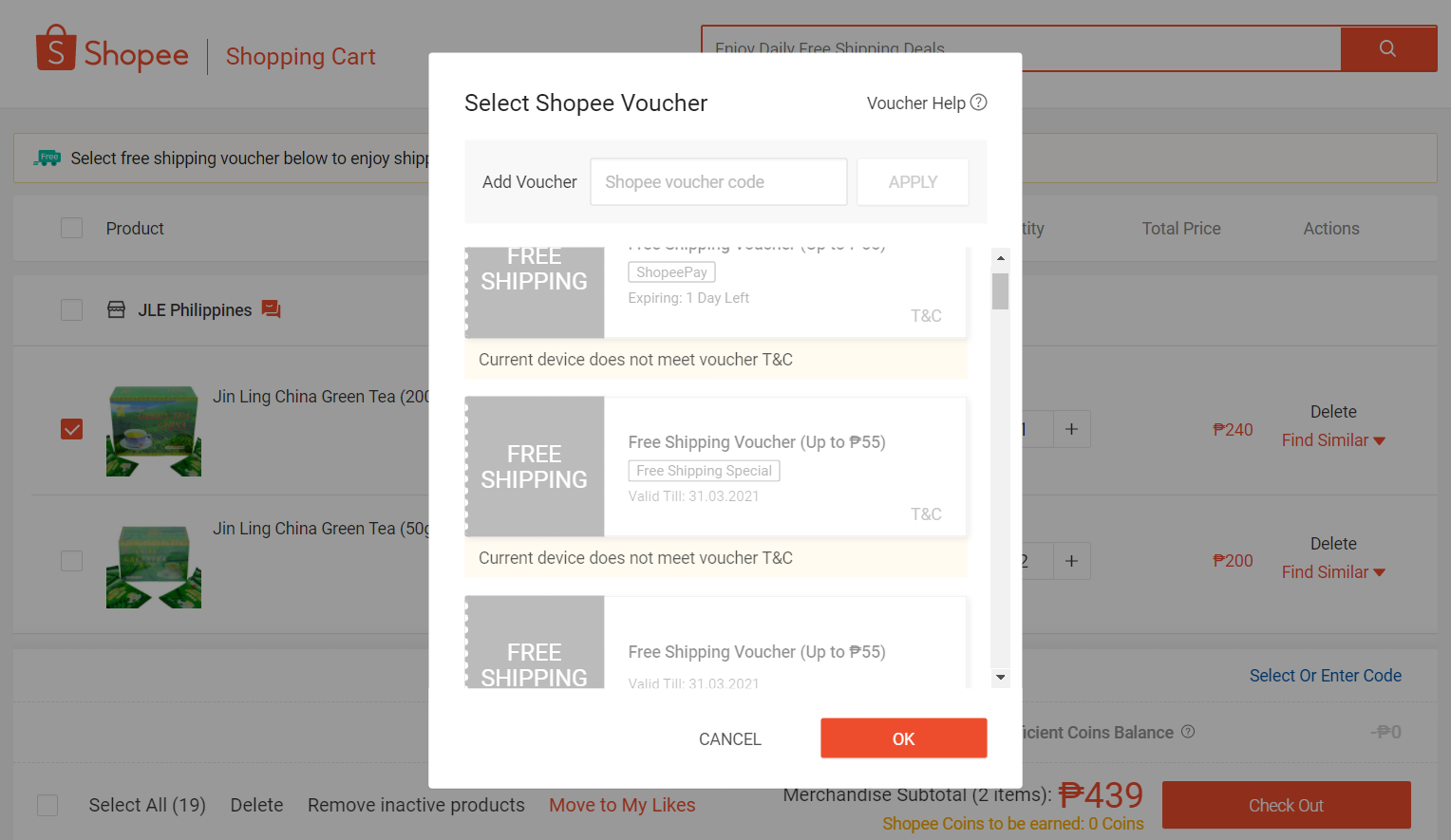

Shopee Free Shipping Voucher Codes, Missing During Sale Dates Do This!

30/03/2021 06:58 AM

- HEALTH

- Comics

- Libraries & Demo

- Sports Games

- Racing

- Photography

- Transportation

- Media & Video

- Sports

- Health & Fitness

- Weather

- Medical

- Cards & Casino

- Arcade & Action

- Personalization

- Social

- Communication

- Productivity

- Casual

- Shopping

- Tools

- Brain & Puzzle

- Business

- News & Magazines

- Finance

- Lifestyle

- Music & Audio

- Entertainment

- Travel & Local

- Books & Reference

- Education

2014 © Filipino apps and news